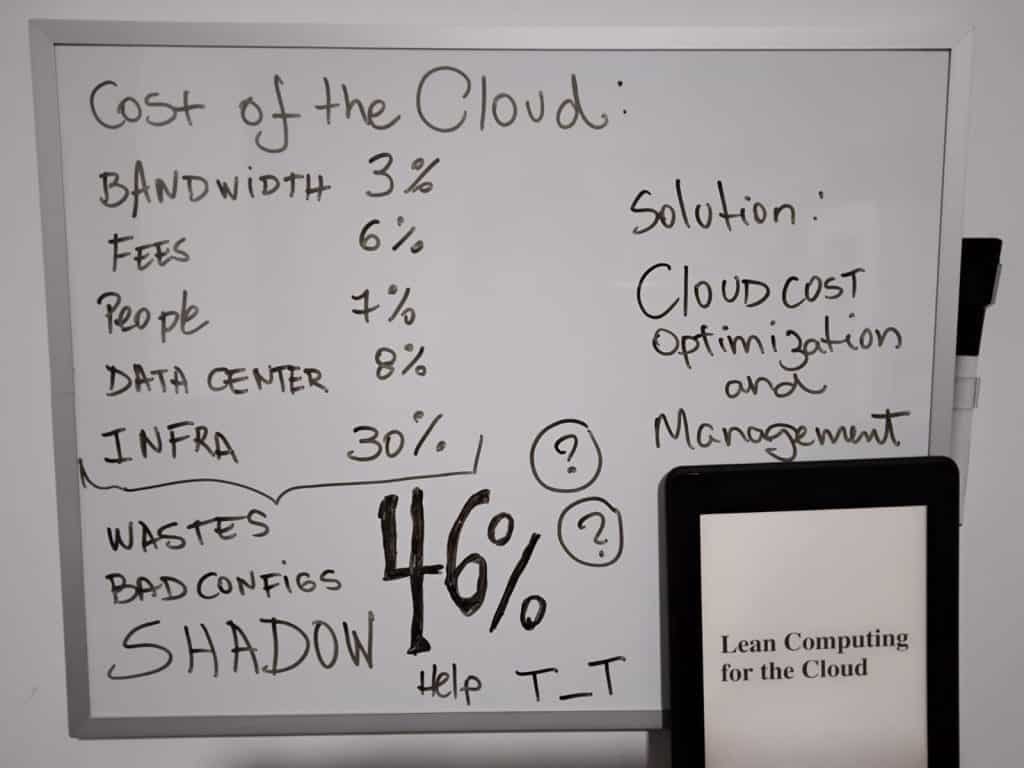

Welcome to the world of cloud cost management! Effective cost management becomes paramount as businesses increasingly embrace the cloud for its scalability and flexibility. If you’re new to this field and find yourself navigating through a maze of unfamiliar terms and jargon, fear not! This article introduces you to the essential terminologies and concepts. Whether you’re a developer, IT professional, or someone keen on optimizing cloud spending, this guide will equip you with the knowledge you need to manage costs and maximize your organization’s cloud investments effectively. So, let’s dive in and discover the key terminologies that will empower you in your cloud cost management journey!

Cloud costs affect everyone, so IT, Finance, Business, and Executive Departments must understand each other. We convey the most important terminology from these areas and ensure mutual understanding.

Activity-Based Costing: Imagine you’re planning a baking business where you make and sell delicious cakes. To understand the cost of each cake and price them appropriately, you need to consider the different activities involved in the baking process.

In this scenario, activity-based costing (ABC) in cloud cost management is similar to breaking down the cost of baking a cake into its various activities. Each activity, such as mixing the batter, baking the cake, decorating, and packaging, incurs costs regarding ingredients, electricity, labor, and other resources. By assigning the costs to each activity, you can get a clearer picture of the total cost of producing a cake.

In the context of cloud cost management, ABC helps you allocate costs to specific activities or resources in your cloud environment. Instead of simply looking at the overall cost of running your cloud infrastructure, ABC allows you to analyze and understand the cost drivers for each activity or service utilized. For example, you can determine the cost of running a specific application, storing data, or processing transactions.

By leveraging ABC in cloud cost management, you gain insights into the cost drivers and can make more informed decisions regarding resource allocation, optimization, and pricing. It helps you identify areas where costs are concentrated and allows for better cost control and management. Just like understanding the cost breakdown of baking a cake helps you price it accurately, ABC enables you to allocate costs more effectively and make data-driven decisions to optimize your cloud spending.

Allocation Metadata: In cloud cost management, allocation metadata refers to the information associated with allocating costs to specific resources or services within a cloud environment. It helps track and categorize costs based on various dimensions such as project, department, team, or specific use case. The information used to categorize costs is encapsulated within CSP constructs like resource tags (AWS; Azure) or labels and tags (GCP). In this context, metadata can be differentiated between “Resource Metadata,” where an individual resource is tagged or labeled, or “Hierarchy Metadata,” where categorization is applied to some other construct that groups resources. Examples of allocation metadata include:

→ GCP “labels,” “tags,” and “billing accounts”;

→ AWS “resource tags,” “Linked Accounts,” and “Organizations”;

→ Azure “Subscriptions,” “Resource Groups,” and “resource tags”

Allocation metadata provides granular insights into how costs are distributed across different cloud infrastructure components, allowing organizations to understand the cost drivers better and optimize resource allocation accordingly.

Amortization: in cloud cost management, amortization refers to spreading out the cost of a cloud resource or service over its useful lifespan. Instead of incurring the entire cost upfront, amortization allows organizations to distribute the expense over a specific period. This approach enables better financial planning and budgeting by aligning the cost with the value derived from the resource.

Balance sheet: In the cloud cost management, a balance sheet refers to a financial statement that provides a snapshot of an organization’s financial position at a specific time. It consists of two main sections: assets and liabilities. In cloud cost management, the balance sheet helps track and analyze the costs and financial impact of cloud resources and services. It provides visibility into the value of assets, such as the cloud infrastructure and software licenses, and any liabilities, such as outstanding payments or contractual obligations.

Capital Expense (CAPEX): in cloud cost management, CAPEX refers to the upfront investment made by an organization for acquiring long-term assets or resources related to its cloud infrastructure. It involves purchasing or investing in hardware, software licenses, or other infrastructure components for running cloud-based services. Unlike operational expenses (OPEX), which are recurring costs, CAPEX is a one-time or periodic expenditure to establish the foundation of the cloud infrastructure. Understanding CAPEX is essential for organizations to assess their long-term investment in the cloud and determine the financial impact of acquiring and maintaining the necessary assets.

Cash Flow Statement: A financial document that tracks the movement of money into and out of an organization related to its cloud cost management. It provides a comprehensive view of the organization’s cash inflows, outflows, and net cash flow over a specific period. In cloud cost management, the Cash Flow Statement helps monitor the cash flow associated with cloud-related expenses such as subscriptions, usage fees, and infrastructure investments. By analyzing the Cash Flow Statement, organizations can gain insights into their financial health, assess the impact of cloud costs on overall cash flow, and make informed decisions to optimize spending and cash management. The principal operations are:

→ Operating Activities: The operating activities section of the Cash Flow Statement (CFS) encompasses all the cash inflows and outflows related to a business’s day-to-day operations and revenue generation. It includes changes in cash from activities such as sales of products or services, collection of accounts receivable, depreciation of assets, changes in inventory levels, and payment of accounts payable. Additionally, operating activities encompass various expenses like wages, income tax payments, interest payments, rent, and cash receipts from customer purchases.

→ Investing Activities: Investing activities on a company’s Cash Flow Statement (CFS) encompass the cash inflows and outflows associated with long-term investments to secure the company’s future growth. This category includes transactions like purchasing or selling assets, extending or receiving loans to/from vendors or customers, and payments related to mergers or acquisitions. Additionally, it covers the purchase of fixed assets such as property, plant, and equipment (PPE). In summary, any cash flows resulting from changes in equipment, assets, or investments are classified as investing activities, reflecting the company’s commitment to long-term investment and expansion.

→ Financing Activities: Cash from financing activities on the Cash Flow Statement (CFS) comprises the cash inflows and outflows associated with the company’s financing activities, including raising capital from investors or banks and distributing cash to shareholders. These activities include debt issuance, equity issuance, repurchasing company stock, obtaining or repaying loans, paying dividends to shareholders, and making debt repayments. In essence, cash from financing activities reflects the company’s interactions with external funding sources and the utilization of cash to meet financial obligations and return value to shareholders.

Contribution Margin: Imagine you’re running a lemonade stand business. To understand the profitability of each cup of lemonade sold, you need to consider the concept of contribution margin.

In this scenario, the contribution margin in cloud cost management is similar to the revenue generated by selling each cup of lemonade minus the direct costs of producing that cup. Direct costs include the cost of lemons, sugar, cups, and other ingredients. The contribution margin represents the amount of money that covers your fixed costs and generates profit.

In the context of cloud cost management, the contribution margin helps you assess the profitability of each service or resource utilized in your cloud infrastructure. It allows you to determine the revenue generated by a specific service or application and subtracts the direct costs associated with that service, such as infrastructure costs, licensing fees, and data transfer charges. The resulting contribution margin indicates how much revenue remains to cover your fixed costs and generate profit.

By analyzing the contribution margin for different services or resources in your cloud environment, you can identify which ones are more profitable and contribute significantly to your overall financial performance. This information helps you make informed decisions about resource allocation, pricing strategies, and cost optimization efforts. Just as understanding the contribution margin of each cup of lemonade helps you gauge the profitability of your lemonade stand, analyzing the contribution margin in cloud cost management helps you assess the financial impact of different services and make data-driven decisions to maximize your cloud investment.

Cloud Cost Analytics: Advanced analytics techniques are applied to cloud cost data to gain insights, identify cost drivers, and uncover optimization opportunities.

Cloud Cost Anomalies: Anomalies in the context of Cost management and FinOps are unpredicted variations resulting in increased cloud spending that are larger than expected given historical spending patterns.

Cloud Cost Management: The practice of managing and optimizing costs associated with cloud services and resources.

Commitment-Based Discount: Each CSP allows customers to discount on-demand rates for cloud services in exchange for a commitment to use a minimum level of resources for a specified term. Depending on CSP and the cloud services used, the commitment may be based on the upfront payment for a certain number of resource units, time units, or monetary value, with various payment options and timeframes. Examples of commitment-based discounts include:

→ GCP “Committed Use Discount” (CUD) for Compute Engine and “Reservations” for BigQuery

→ AWS “Reserved Instance” (RI) for EC2 and “Savings Plans” (SP) for SageMaker

→ Azure “Reserved instances” (RI) for VMs

Commitment Break-Even Point (CBEP): in the cloud cost management represents the duration required to offset the total cost of a commitment-based discount, including both upfront and ongoing charges, with the savings obtained from that commitment. It calculates the point at which the cumulative savings from the discount, factoring in utilization rates, equal or exceed the initial cost. Once the break-even point is reached, the commitment-based discount becomes financially advantageous and will not result in overall losses, regardless of the subsequent utilization. This metric helps organizations assess the cost-effectiveness of commitment-based discounts and determine when they become financially beneficial for long-term cost optimization. Imagine you’re planning a trip to a theme park. You have two ticket options: a standard ticket or a discounted season pass. The season pass requires an upfront payment but offers significant savings on each visit. The Commitment Break Even Point (CBEP) is like the moment when the total savings from the discounted pass surpass the cost of the standard ticket. After reaching this point, every additional visit with the season pass becomes a net gain financially.

Cost Allocation: The process of assigning cloud costs to specific departments, projects, or users for tracking and accountability purposes.

Cost attribution: You’re a chef in a restaurant and responsible for managing your dishes’ costs. Cost attribution in cloud cost management is similar to identifying the ingredients and resources used to prepare a specific dish on your menu. When you create a dish, you carefully analyze the cost of each ingredient that goes into it. You consider the price of the meat, vegetables, spices, and other components. Each ingredient has a specific cost, and by attributing the costs to them, you can understand the overall expenses involved in creating the dish.

Similarly, in cloud cost management, cost attribution involves identifying the components or resources contributing to the overall cloud costs. You analyze the various cloud services, virtual machines, storage, networking, and other resources used in your cloud environment. By attributing costs to each of these resources, you can gain insights into which components drive most of your cloud expenses.

Cost attribution helps you understand the cost breakdown and enables you to make informed decisions about resource optimization, usage patterns, and potential areas for cost reduction. Just as a chef carefully examines the costs of ingredients to ensure profitability, cost attribution in cloud cost management allows you to analyze and optimize your cloud spending for better financial efficiency.

Cost attribution vs. cost allocation: Imagine you’re planning a picnic with your friends. You’ve decided to share the expenses equally among everyone. Now, when it comes to cost attribution and cost allocation, think of cost attribution as identifying the specific items or expenses that contribute to the overall cost of the picnic, while cost allocation refers to how those costs are divided or assigned among the participants.

Cost attribution is like listing all the items you need for the picnic, such as food, drinks, and supplies. Each item is attributed to a specific cost category, helping you understand the individual components that contribute to the total cost.

On the other hand, cost allocation is like dividing the total cost among your friends. You calculate the cost per person by dividing the total cost by the number of participants, ensuring everyone pays their fair share.

In cloud cost management, the same principles apply. Cost attribution involves identifying the specific cloud resources, services, or activities that contribute to your overall cloud costs. It helps you understand which services or resources are driving the majority of your expenses.

Cost allocation, on the other hand, involves assigning those costs to different cost centers, departments, or projects within your organization. It allows you to distribute the costs fairly and allocate them based on usage or specific business needs.

By distinguishing between cost attribution and allocation, you can gain better visibility into your cloud spending, understand the key cost drivers, and make informed decisions to optimize resource usage and allocation in your cloud environment.

Cloud Cost Management Tools: Software tools and platforms designed specifically for managing and optimizing cloud costs, offering features like cost tracking, budgeting, and alerting.

Cloud Cost Reporting: Generating regular reports and dashboards to track and communicate cloud costs across the organization.

Cost to serve: Imagine you’re planning a road trip with your friends. You have a limited budget and want to ensure you allocate your funds wisely. In this scenario, the concept of “cost to serve” in cloud cost management can be compared to the expenses associated with each stop or destination on your road trip.

Each destination on your road trip has its own costs, such as accommodation, food, activities, and transportation. The service cost represents the total expenses incurred for visiting a specific destination, including direct and indirect costs. Direct costs include accommodation fees and attraction tickets, while indirect costs include transportation expenses and meals.

In cloud cost management, the cost to serve refers to the total expenses incurred for utilizing a specific cloud service or resource. It encompasses both the direct costs associated with that service, such as usage and licensing costs, and the indirect costs, like data transfer and support fees. By understanding the cost to serve each cloud service, you can evaluate the overall expenses incurred and make informed decisions about resource allocation, usage optimization, and cost control.

Just as you consider the cost to serve at each destination on your road trip to ensure you’re managing your budget effectively, analyzing the cost to serve in cloud cost management helps you assess the financial impact of different services and resources and optimize your cloud spending for maximum efficiency.

Cost-driven anomalies: In cloud cost management, cost-driven anomalies refer to unexpected or abnormal fluctuations in cloud expenses that can significantly impact the overall cost structure. These anomalies can occur due to various factors, such as changes in resource utilization, unexpected spikes in demand, inefficient resource provisioning, or misconfigurations. Identifying and addressing cost-driven anomalies is crucial for maintaining cost efficiency and optimizing cloud spend. By closely monitoring cost patterns and utilizing cost management tools, organizations can detect and investigate these anomalies, understand the underlying causes, and take appropriate actions to mitigate the financial impact. Proactively managing cost-driven anomalies helps ensure that cloud resources are utilized optimally, minimize unnecessary expenses, and improve cost management practices for better financial outcomes.

Cost Explorer: Cloud service providers provide tools that allow users to visualize and analyze their cloud costs, including spending trends and forecasts.

Cost Forecasting: The ability to predict future cloud costs based on historical data and usage patterns.

Cost Governance: Establishing policies, processes, and controls to effectively manage and govern cloud costs.

Cost to serve: Imagine you’re planning a road trip with your friends. You have a limited budget and want to ensure you allocate your funds wisely. In this scenario, the concept of “cost to serve” in cloud cost management can be compared to the expenses associated with each stop or destination on your road trip.

Each destination on your road trip has its own costs, such as accommodation, food, activities, and transportation. The service cost represents the total expenses incurred for visiting a specific destination, including direct and indirect costs. Direct costs include accommodation fees and attraction tickets, while indirect costs include transportation expenses and meals.

In cloud cost management, the cost to serve refers to the total expenses incurred for utilizing a specific cloud service or resource. It encompasses both the direct costs associated with that service, such as usage and licensing costs, and the indirect costs, like data transfer and support fees. By understanding the cost to serve each cloud service, you can evaluate the overall expenses incurred and make informed decisions about resource allocation, usage optimization, and cost control.

Just as you consider the cost to serve at each destination on your road trip to ensure you’re managing your budget effectively, analyzing the cost to serve in cloud cost management helps you assess the financial impact of different services and resources and optimize your cloud spending for maximum efficiency.

Cost Optimization: The process of minimizing cloud spending while maximizing the value and efficiency of resources.

Cost Optimization Recommendations: Automated suggestions provided by cloud service providers to help users identify and implement cost-saving opportunities within their infrastructure.

Cost & Usage Data: The data source to which CSPs publish and native cost data can be derived when billable cloud services are consumed. Examples of data sources include:

→ AWS CUR (Cost & Usage Report)

→ Azure Consumption API; Azure Cost Management Exports

→ GCP BigQuery Cloud Billing Data Tables; GCP Cloud Billing Report; Billing Dashboard

Cost-weighted allocation: Imagine you and your friends are planning a road trip. Each person in the group has their own car, and you’ve agreed to share the expenses equally. However, you realize that some cars are more fuel-efficient than others, which means they will incur lower fuel costs during the trip. To ensure a fair distribution of expenses, you implement a cost-weighted allocation method.

In this scenario, the fuel cost is assigned a weight based on the fuel efficiency of each car. The cars that consume less fuel per mile are given a lower weight, while those that are less fuel-efficient receive a higher weight. By incorporating these weights, the total fuel cost is divided among the group to reflect the varying costs incurred by each car. This ensures that everyone contributes proportionally to the overall fuel expenses based on their car’s fuel efficiency.

Similarly, in cloud cost management, cost-weighted allocation is applied to distribute expenses among different resources or services used by various teams or departments within an organization. Each resource or service is assigned a cost weight based on its consumption rate or pricing structure. The total cost is then allocated to different teams based on the proportionate usage of these resources or services. This method ensures that teams responsible for higher-cost resources contribute a larger share of the overall expenses, while those utilizing lower-cost resources have a smaller contribution.

By implementing cost-weighted allocation in cloud cost management, organizations can ensure a fair distribution of expenses that aligns with the costs associated with different resources or services. It promotes accountability and transparency by reflecting the actual usage and cost structure, allowing teams to understand their proportional share in the overall cloud expenses.

you’re driving a car on the road. The speed at which you drive depends on several factors, such as traffic conditions, road conditions, and the urgency of reaching your destination. In this analogy, the “demand driver” concept in cloud cost management can be compared to the factors influencing the demand for cloud resources and services.

A demand driver represents the variables or factors that affect the consumption and utilization of cloud resources. Just like the different factors that influence your driving speed, demand drivers can include aspects such as the number of users accessing a particular service, the amount of data being processed, or the frequency of resource-intensive tasks.

Understanding the demand drivers for your cloud services is crucial for effective cost management. By analyzing these drivers, you can identify the key factors contributing to increased resource usage and costs. This knowledge allows you to optimize your cloud usage, right-size your resources, and allocate them efficiently based on the changing demand patterns.

Just as you would adjust your driving speed based on the traffic and road conditions, being aware of the demand drivers in cloud cost management enables you to navigate the cloud landscape more effectively and make informed decisions to control and optimize your cloud costs.

Depreciation: refers to the gradual reduction in the value of an asset over time. Depreciation is an accounting method in cloud cost management that allocates the cost of cloud assets, such as servers, software licenses, or networking equipment, over their estimated useful life. Depreciation helps organizations account for the wear and tear, obsolescence, and loss in value of these assets as they are utilized for cloud operations.

Double mortgage period: When you have two sets of costs simultaneously. For example, when you have both on-premises and cloud costs, like strategies or during the migration.

Earnings before interest, taxes, depreciation, and amortization (EBITDA): a financial metric commonly used to assess a company’s operating performance. In cloud cost management, EBITDA measures profitability by excluding non-operating expenses and accounting practices, such as interest payments, taxes, depreciation, and amortization. It allows organizations to evaluate their core business operations and profitability without the influence of financial factors that are not directly related to day-to-day operations.

Even-spread cost allocation: Imagine you and your friends are planning a pizza party. You decide to split the pizza cost evenly among everyone to make it fair. Instead of calculating individual costs based on each person’s pizza consumption, you use an even-spread cost allocation method. This means that regardless of whether someone ate one slice or three slices, everyone contributes an equal share towards the total cost of the pizza. This way, the cost is evenly distributed among all participants, ensuring everyone pays their fair share.

In cloud cost management, the concept of even-spread cost allocation is similar. Instead of a pizza party, you have cloud resources used by different teams or departments within an organization. Each team may utilize different resources, such as virtual machines or storage, but all teams must allocate the cost fairly. With even-spread cost allocation, the total cost of the cloud resources is divided equally among the teams, regardless of the specific usage by each team. This approach ensures that each team contributes a proportionate share of the overall cost, promoting fairness and transparency in cost allocation.

The even-spread cost allocation method simplifies dividing costs among different teams or departments in cloud cost management. It eliminates the complexity of tracking individual resource usage and provides a standardized approach to cost allocation. By using this method, organizations can ensure equitable distribution of costs and facilitate collaborative cost management across different teams, promoting a shared responsibility for cloud expenses.

Fixed costs: in the cloud cost management refer to expenses that remain constant regardless of the usage or level of resources in the cloud. These costs are typically associated with infrastructure or services with a fixed price regardless of usage or demand. Unlike variable costs that fluctuate based on resource consumption, fixed costs remain stable. Examples of fixed costs in cloud cost management may include subscription fees, base-level service charges, or ongoing maintenance costs. Understanding fixed costs is crucial for budgeting and forecasting as they form a consistent part of the overall cost structure in cloud operations.

Fully-loaded costs: Reflect the actual discounted rates a company is paying for cloud resources, equitably factor in shared costs, and are mapped to the business’s organizational structure. Essentially, they show your cloud’s actual costs and what drives them.

Net Present Value (NPV): is a financial metric used in cost management to assess the value of an investment or project over time. In the context of cloud cost management, NPV helps evaluate the profitability and financial viability of cloud-related initiatives. NPV considers the time value of money by discounting future cash flows to their present value. A positive NPV indicates that the investment is expected to generate more value than the initial cost, while a negative NPV suggests a potential loss.

On-Demand Instances: Resources that can be provisioned and used instantly without any upfront commitment, billed at regular rates.

Operating Expense (OPEX): refers to the ongoing costs associated with the day-to-day operation and maintenance of cloud services and resources. In cloud cost management, OPEX includes subscription fees, usage-based charges, support and maintenance fees, and any other recurring costs incurred to keep the cloud environment running smoothly. OPEX is typically contrasted with Capital Expense (CAPEX), which involves upfront investments in infrastructure or assets. OPEX provides flexibility and scalability as organizations only pay for the resources they consume, allowing them to adjust their costs based on actual usage. By effectively managing OPEX, businesses can optimize their cloud spending, control expenses, and ensure cost-efficiency in their operations.

Opportunity Cost: is a fundamental economic concept that refers to the value or benefits sacrificed when choosing one option over another. It represents the potential gains foregone by selecting a specific activity or investment instead of an alternative. Individuals and businesses can make more informed decisions by recognizing and considering opportunity costs. It’s important to acknowledge that opportunity costs are often hidden or overlooked, as they are not always immediately apparent. Awareness of the potential missed opportunities associated with different choices enables better decision-making and weighing various alternatives’ potential benefits and drawbacks.

Formula and Calculation of Opportunity Cost

Opportunity Cost = FO − CO, where:

FO = Return on best forgone option

CO = Return on chosen option

Profit and Loss (P&L): an income statement is a financial report that provides an overview of the revenues, expenses, and net profit or loss generated by a business over a specific period. In cloud cost management, the P&L statement helps track and analyze the financial performance related to cloud expenses and revenue. It outlines the costs incurred for cloud services, including infrastructure, software, and maintenance, and any associated revenues, such as income generated from cloud-based products or services.

Pay-as-you-go: A pricing model where users pay for cloud services based on actual usage, typically measured in compute hours, storage space, or data transfer.

Reserved Instances: Pre-paid resources with discounted pricing for a fixed term, offering cost savings for long-term usage.

Resource Rightsizing: The process of optimizing resource allocation by matching resource specifications to actual workload requirements, thereby reducing costs

Resource Tagging: Assign metadata tags to cloud resources for better cost tracking, management, and allocation.

Return on Investment (ROI): refers to a metric that measures the profitability and efficiency of investments made in cloud services. ROI calculates the financial return from cloud investments relative to the costs incurred. It helps organizations assess the value and effectiveness of their cloud initiatives by comparing the gains achieved against the expenses involved. A positive ROI indicates that the cloud investments are generating more value than the costs, while a negative ROI suggests a potential need for optimization or reevaluation of cloud strategies.

Severity: Once you have established a minimum threshold, you still need to identify a low-impact anomaly from a high-impact one. Usually it’s best if the business users have some control over what you call a low-medium-high-critical anomaly and also being able to set alerts only on the high/critical ones and leave the low-medium for offline analysis.

Showback/Chargeback: Showback in cloud cost management refers to the practice of presenting cost and usage information to internal stakeholders or departments within an organization. It is a way to provide transparency and visibility into the cost incurred by different teams or projects in using cloud resources. Showback enables organizations to track and allocate costs, understand resource consumption patterns, and promote accountability.

Spot Instances: Resources are offered at significantly reduced prices compared to on-demand instances, with the caveat that the cloud provider can reclaim them anytime.

Variable costs: in the cloud cost management refer to expenses that fluctuate based on the actual usage or consumption of resources in the cloud. These costs are directly influenced by factors such as the amount of data stored, the number of compute instances used or the duration of network usage. Unlike fixed costs that remain constant, variable costs are directly tied to the level of resource utilization. For example, if you increase the number of virtual machines or scale up your storage capacity, your variable costs will increase accordingly. Understanding variable costs is essential for optimizing resource usage and identifying opportunities for cost savings in cloud environments. By effectively managing and controlling variable costs, organizations can achieve greater efficiency and maximize the value derived from their cloud investments.

Unblended rates: In cloud cost management, unblended rates refer to the pricing structure where resource costs vary based on usage or duration. This means the rates associated with those resources decrease as you use certain resources more or for longer periods within a billing cycle. When reviewing your bill, you may notice that identical or similar resources have different costs, with some being higher than others. This discrepancy is due to the unblended rates, which reflect the varying pricing tiers based on usage. Understanding unblended rates is crucial for optimizing cloud costs, as it allows you to identify areas where resource usage can be adjusted to minimize expenses.

Unit Economics: Imagine you’re planning to start a lemonade stand business. To understand the unit economics of your business, you need to break down the costs and revenues associated with each cup of lemonade you sell. Imagine that for every cup of lemonade, you have the cost of lemons, sugar, water, cups, and other ingredients. These include the “cost per unit” or the expenses you incur to produce one cup of lemonade. On the revenue side, you have the selling price of each cup of lemonade. By subtracting the cost per unit from the selling price per unit, you can determine the profit you make on each cup of lemonade sold. Understanding unit economics helps you analyze the profitability of your business, make informed pricing decisions, and optimize your costs to maximize profits.

In cloud cost management, the concept of unit economics is similar. Instead of lemonade cups, you have cloud resources like virtual machines, storage, or network usage. Each resource has associated costs, such as hourly rates or storage fees, comprising the unit cost. On the revenue side, you have the value derived from utilizing these resources, such as the revenue generated by running applications or providing services. By analyzing the unit economics of your cloud usage, you can understand the cost per unit of resource and the revenue generated per unit. This information helps you optimize your cloud costs, identify cost reduction or revenue growth opportunities, and make data-driven decisions to ensure your cloud usage is financially sustainable and profitable. Important to know:

Unit Cost: Imagine you’re planning to bake some cookies. You have a recipe requiring ingredients like flour, sugar, eggs, and chocolate chips. Each ingredient has its own cost associated with it, and you want to calculate the total cost of making each cookie.

In this scenario, the unit cost refers to the cost of each ingredient per unit of measurement. For example, flour costs $2 per pound; sugar costs $1 per cup, eggs $0.50 each, and chocolate chips $3 per bag. By knowing the unit cost of each ingredient, you can determine the cost of the specific quantity needed for each cookie. Let’s say the recipe requires 1/2 cup of sugar, two eggs, and 1/4 cup of chocolate chips. You can multiply the unit cost of each ingredient by the required quantity to calculate the cost of each ingredient used per cookie. Finally, by summing up the ingredients’ costs, you can determine the unit cost of making each cookie.

In cloud cost management, the concept of unit cost is similar. Instead of baking ingredients, you have various cloud resources or services such as virtual machines, storage, or data transfer. Each resource has its own cost per unit of measurement, such as per hour, per gigabyte, or per request. By knowing the unit cost of each resource, you can calculate the cost of utilizing a specific quantity or duration of that resource. This allows you to understand the cost implications of using different resources and make informed decisions to optimize your cloud spending.

Considering the unit cost in cloud cost management, you can effectively track and manage the expenses associated with specific resources or services. It enables you to calculate the cost of using cloud resources at a granular level and compare different options. This knowledge helps you optimize your resource allocation, identify cost-saving opportunities, and ensure efficient utilization of cloud services while controlling your overall expenses.

Unit Metrics: Imagine you’re planning a road trip from one city to another. You have a limited budget for fuel, and you want to make sure you use your money wisely. To do that, you must understand how efficiently your vehicle consumes fuel based on different factors.

In this scenario, unit metrics in cloud cost management are similar to the fuel efficiency of your vehicle. Just like you monitor your car’s mileage per gallon (MPG), unit metrics help you track and measure the performance and efficiency of your cloud resources or services. Unit metrics can include measurements like CPU utilization, storage capacity, network bandwidth, or the number of requests processed.

By analyzing unit metrics, you gain insights into how effectively your resources are being utilized and whether you’re getting the most value out of them. For example, suppose you have a virtual machine with low CPU utilization. In that case, it means the resource is not efficiently utilized, and you may be paying for capacity that you’re not fully leveraging. By monitoring and optimizing unit metrics, you can identify areas where you can improve, such as downsizing resources, adjusting configurations, or adopting more efficient alternatives.

Unit metrics in cloud cost management provide you with valuable information to make informed decisions about resource allocation, capacity planning, and cost optimization. By understanding how efficiently your resources are being utilized, you can optimize your cloud spending, avoid unnecessary costs, and ensure you’re getting the most out of your cloud investment, just like you strive to get the best fuel efficiency during your road trip.

Upfront Charge: Let’s imagine you’re planning a trip to a popular tourist destination. You have two options for booking accommodations: a regular hotel room or a discounted reservation at a hotel. Regarding the discounted reservation, the hotel offers you the choice to pay the full cost upfront or make a partial upfront payment with a reduced periodic charge. The upfront charge is like paying a deposit or prepaying a portion of your hotel stay before you arrive. By choosing this option, you secure the discounted rate and ensure your room is reserved for your desired dates. This upfront payment gives you peace of mind and allows you to enjoy cost savings overall.

Similarly, an upfront charge works in cloud cost management, allowing you to secure discounted pricing or reserved instances by paying in advance. In cloud cost management, an upfront charge refers to the payment made in advance for a reserved instance or service reservation. When opting for a reserved instance, cloud service providers may offer different payment options, including an upfront charge. This upfront charge allows you to secure the reserved instance by paying a portion or the entire cost upfront. By making this upfront payment, you can often benefit from discounted rates or pricing models that offer cost savings over time. It’s important to understand the upfront charge as it directly impacts the overall cost and financial planning associated with utilizing reserved instances in cloud cost management.

Understanding the cloud cost glossary, terminologies, and principal topics is crucial for anyone working in cloud cost management. With the rapid growth of cloud computing and its impact on business operations, having a solid grasp of these concepts will empower you to make informed decisions and optimize your organization’s cloud spending.

We have covered a range of essential terms in this article, including amortization, balance sheet, capital expense (CAPEX), cash flow statement, depreciation, etc. However, this is just the beginning. Cloud cost management is a vast and ever-evolving field, and there are numerous other topics to explore, such as show back, unit economics, cost allocation, and demand drivers, to name a few.

We invite you to check out our other articles and resources to delve deeper into these subjects and expand your knowledge. Whether you’re a beginner or an experienced professional, there is always more to learn in the dynamic world of cloud cost management. Stay curious, stay informed, and continue exploring the fascinating realm of cloud cost optimization.

See ya

o/